The Small Business Administration (SBA) partners with lenders to offer financing programs that help small businesses access credit. SBA loans range from small to large and can be used for most business purposes, including long-term fixed assets and operating capital.

These loans have different features and terms than conventional loans, and can offer businesses several key advantages.

Businesses that operate in rural areas may be eligible for financing through the U.S. Department of Agriculture’s Business & Industry loan program. USDA loans are designed to maintain employment and improve the economic climate of rural areas by strengthening the availability of private credit. Loans are available to businesses of any size for a variety of purposes.

Manage your cash flow more effectively with a line you can access instantly. Our rates are competitive, and you'll have the convenience of a line that you can pay down and use again to help your business's cash flow needs.

We'll put a package together that considers the entire financial picture. Whether you're purchasing or refinancing, our affordable, monthly payment plans are cash-flow friendly.

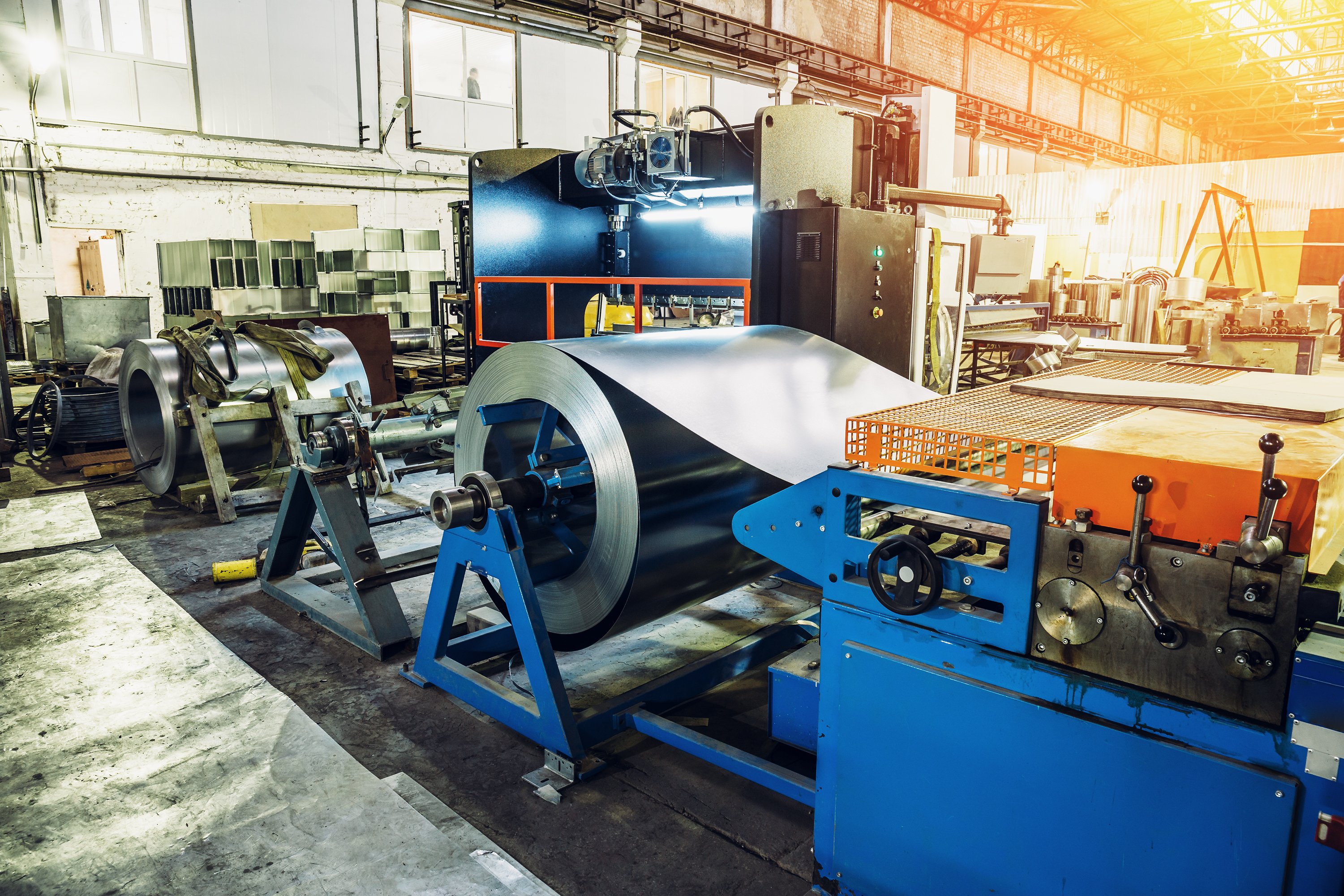

Equipment leasing is a great option for businesses who may have limited capital or need new equipment frequently in order to remain competitive.

Unlike other traditional leasing companies, we never charge termination or prepayment penalties should you need flexibility during the term of your lease. In addition, coordinating all your equipment financing activity with one bank is convenient and saves you valuable time.

At Lincoln Savings Bank, we understand that being successful in today's environment requires planning, motivation, strategy, leadership, success, and action. Our goal is to be your lifelong partner, helping you achieve your business goals as your business grows and changes.

Member FDIC

[fa icon="phone"] (800) 588-7551

[fa icon="envelope"] bln@mylsb.com

[fa icon="home"] 508 Main Street, Reinbeck IA